UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant | |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | | Preliminary Proxy Statement.Statement |

| ☐ | |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)). |

| ☑ | | Definitive Proxy Statement |

☒☐ | | Definitive Proxy Statement.Additional Materials |

| ☐ | |

☐ | | Definitive Additional Materials. |

| |

☐ | | Soliciting Material Pursuant to§240.14a-12.under §240.14a-12 |

(Name of Registrant as Specified

in itsIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if

Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | | No fee required |

☒☐ | | No fee required. |

| |

☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

| | | | |

☐ | | Fee paid previously with preliminary materials.materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Letter from our Board of Directors

| | | | | | | | | | | |

Dear Shareholders: It is my honor to pen this letter to you, as your new Chairman of the Board. I know I speak on behalf of all members of the Board of Directors when I thank past chairman Wayne Hoovestol for his years of commitment to Green Plains and its shareholders. I am eager to continue the legacy of strong leadership, working alongside dedicated Green Plains employees as they continue to drive toward success through an intensive company transformation into an ag-tech innovator creating sustainable ingredients that matter. In 2023, we forged new partnerships and enhanced existing ones, navigated challenging markets, and celebrated several successes. We made progress in several areas of environmental stewardship and responsible business, focusing on the planet and people, and continued to enhance transparency and disclosure in our 2023 Sustainability Report. As we move forward in 2024, Green Plains remains committed to its transformation into the biorefinery platform of the future, making more with less while helping to reduce the world’s carbon emissions. We cannot accomplish our goals without our employees, customers, shareholders, and communities. Thank you for your support.

Sincerely, James D. Anderson The Board of Directors | | “As we move forward in 2024, Green Plains remains committed to its transformation into the biorefinery platform of the future, making more with less while helping to reduce the world’s carbon emissions.” |

| ☐ |

| Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | |

| 2 | | |

| | (1) | | Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

2018 ANNUAL MEETING

OF SHAREHOLDERS

AND PROXY STATEMENT

March 29, 2018

Dear Shareholder,

You are cordially invited to attend the 2018 Annual Meeting of Shareholders of Green Plains Inc. to be held at 10:00 a.m., Central Standard Time, on Wednesday, May 9, 2018, at the Omaha Marriott Downtown at the Capital District located at 222 N 10th Street, Omaha, Nebraska 68102.

The Notice of Annual Meeting of Shareholders Proxy Statement containing information about matters to be acted upon, Proxy Card and 2017 Annual Report are enclosed.

Please use this opportunity to take part in the affairs of your company. Whether or not you plan to attend the Annual Meeting of Shareholders, please complete, date, sign and return the accompanying Proxy Card in the enclosed postage-paid envelope, or vote via the Internet or telephone. Please refer to the Proxy Card for instructions on voting via the Internet or telephone or, if your shares are registered in the name of a broker or bank, please refer to the information forwarded by the broker or bank to determine if Internet or telephone voting is available to you. If you attend the Annual Meeting of Shareholders, you may revoke the proxy and vote in person.

On behalf of the Board of Directors, we appreciate your continued interest in your company.

Sincerely,

Wayne Hoovestol

Chairman of the Board of Directors

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on May 9, 2018

The 2018 Annual Meeting of Green Plains Inc. will be held at 10:00 a.m., Central time, on Wednesday, May 9, 2018, at the Omaha Marriott Downtown at the Capital District located at 222 N 10th Street, Omaha, Nebraska 68102, for the following purposes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | DATE AND TIME 10:00 a.m., Central Daylight Time, on Tuesday,

May 7, 2024 LOCATION www.meetnow.global/MNVQDLQ RECORD DATE March 13, 2024 | | 1. | | Items of Business |

| | | | |

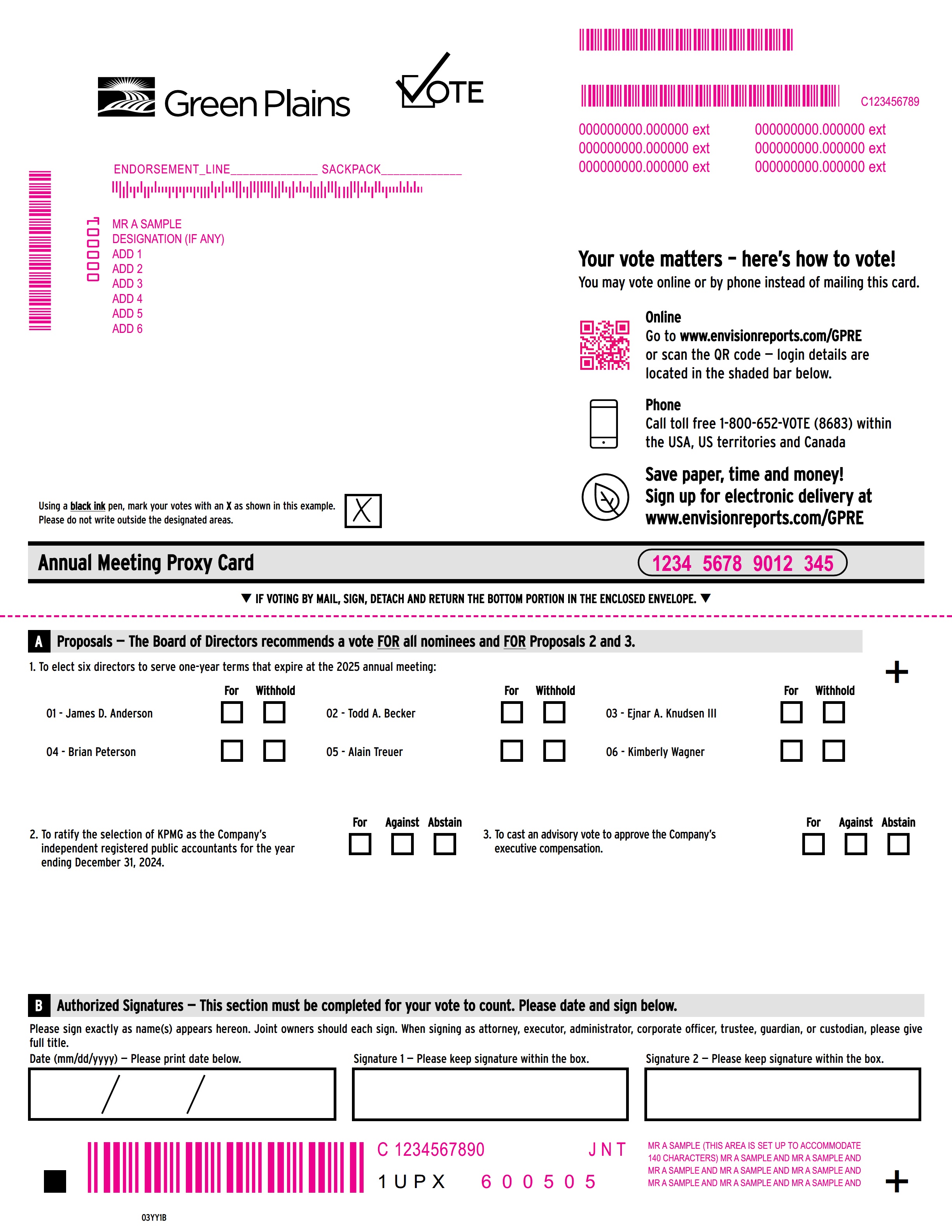

| | Proposals | Board Vote Recommendation | For Further Details |

| | | | | |

| | | | | | | | | |

| | | | | | 1.To elect foursix directors to serve three-yearone-year terms that expire at the 20212025 annual meeting;meeting | Vote FORall nominees | u Page 14 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | 2.To ratify the selection of KPMG as the Company’s independent registered public accountants for the year ending December 31, 2024 | 2.Vote FOR | u Page 36 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | 3.To cast an advisory vote to approve the company’sCompany’s executive compensation; andcompensation | Vote FOR | u Page 42 |

| | 3. | | | | | | | |

| | | | | | |

| | | | | | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors recommends a vote “For” all nominees in Proposal 1 and a vote “For” Proposal 2.

The foregoing items are more fully described in the accompanying Proxy Statement. We have fixed the close of business on March 15, 2018, as the Record Date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. Each share of our Common Stock is entitled to one vote on all matters presented at the Annual Meeting. Dissenters’ rights are not applicable to these matters.

Important Notice Regarding the Availability of Proxy Materials for Shareholder Meeting to be held on May 9, 2018. Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials by notifying you of the availability of our proxy materials on the Internet. Instead of mailing paper copies of our proxy materials, we sent shareholders the Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 9, 2018, with instructions for accessing the proxy materials and voting via the Internet (the “Notice”). The Notice, which was mailed on or around March 29, 2018, also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose.The Notice, the Proxy Statement and our 2017 Annual Report may be accessed atwww.edocumentview.com/GPRE.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES VIA THE TOLL-FREE TELEPHONE NUMBER OR OVER THE INTERNET, AS PROVIDED IN THE ENCLOSED MATERIALS. IF YOU REQUESTED A PROXY CARD BY MAIL, YOU MAY SIGN, DATE AND MAIL THE PROXY CARD IN THE ENVELOPE PROVIDED.

By Order of the Board of Directors,

Michelle Mapes

Corporate Secretary

Omaha, Nebraska

March 29, 2018

TABLE OF CONTENTS

| | |

| | | Page | | | | | | | |

| COMMONLY USED DEFINED TERMS

| | 1 | | | | | | |

| PROXY SUMMARY

| How To Vote Whether or not you expect to attend the annual meeting online, we urge you to vote your shares via the following: INTERNET Go to: www.envisionreports.com/GPRE PHONE Call our toll-free telephone number 1-800-652-VOTE (8683) within the USA, US Territories and Canada MAIL Sign, date and mail the proxy card in the envelope provided. | | | 2

| PROXY STATEMENT

| 6 |

CORPORATE GOVERNANCE

| | 7 |

Independent Directors

| | 7 |

MeetingsThe foregoing items are more fully described in the accompanying Proxy Statement. Each share of our Common Stock is entitled to one vote on all matters presented at the Annual Meeting. Dissenters’ rights are not applicable to these matters. To provide a safe experience for our stockholders and employees, as well as to provide expanded access, improved communications and cost and time savings for our shareholders and the Company, we will once again conduct a virtual annual meeting. You will be able to attend and participate in the meeting by visiting www.meetnow.global/MNVQDLQ, where you will be able to listen to the meeting live, submit questions, and vote. To access the online meeting, you must have the information that is printed on the shaded bar area located on the reverse side of the Notice. A password is not required for this meeting. By Order of the Board of Directors, Michelle Mapes Corporate Secretary Omaha, Nebraska March 28, 2024 Important Notice Regarding the Availability of Proxy Materials for Shareholder Meeting to be held on May 7, 2024. Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials by notifying you of the availability of our proxy materials on the Internet. Instead of mailing paper copies of our proxy materials, we sent shareholders the Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 7, 2024, with instructions for accessing the proxy materials and voting via the Internet (the “Notice”) and attending the Annual Meeting online. The Notice, which was mailed on or around March 28, 2024, also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose. The Notice, the Proxy Statement and our 2023 Annual Report may be accessed at www.edocumentview.com/GPRE.

|

Table of Contents

| | | | | |

| | 7 |

| | 7 |

| | 7 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | 8 |

| | 9 |

| | 10 |

| | 10 |

| | 11 |

| | 11 |

| |

| | 11 |

| |

| |

| | 13 |

| | 13 |

| | 14 |

| | | 14 |

| | 16 |

| |

| |

| |

| |

| |

COMMONLY USED DEFINED TERMS

CompanySafe Harbor for Forward-Looking Statements

Any statements in this Proxy Statement that are not historical, including statements concerning plans and

Regulatory Defined Terms:objectives of management for future operations, economic performance or related assumptions, are forward-looking statements made in accordance with safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “outlook,” “plan,” “predict,” “may,” “could,” “should,” “will” and similar expressions, as well as statements regarding future operating or financial performance or guidance, business strategy, environment, key trends and benefits of actual or planned acquisitions. We believe our expectations regarding future events are based on reasonable assumptions; however, these assumptions may not be accurate or account for all risks and uncertainties. Consequently, forward-looking statements are not guaranteed. Important factors that could cause actual results to differ materially from those in the forward-looking statements are described under Part I, Item 1A, Risk Factors, and Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2023 Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Certain statements contained in this Proxy Statement, particularly pertaining to our ongoing transformation into the biorefinery platform as well as sustainability performance, goals, and initiatives, are subject to additional risks and uncertainties, including regarding gathering and verification of information and related methodological considerations; our ability to implement various initiatives under expected timeframes, cost, and complexity; our dependency on third-parties to provide certain information and to comply with applicable laws and policies; and other unforeseen events or conditions. These factors, as well as others, may cause results to differ materially and adversely from those expressed in any of our forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof. We will not undertake and specifically decline any obligation to update any forward-looking statements, except as required under applicable law. Web Links

Web links throughout this document are provided for convenience only, and information on the company's website is not incorporated by reference into this Proxy Statement.

| | | | | |

| Green Plains; the company; GPI | Green Plains Inc. |

Exchange Act | | Securities Exchange Act of 1934, as amended |

Fleischmann’s Vinegar; Fleischmann’s; FVC | | Fleischmann’s Vinegar Company, Inc. |

GPP | | Green Plains Partners LP |

NASDAQ | | The Nasdaq Global Market |

SEC | | Securities and Exchange Commission |

Securities Act | | Securities Act of 1933, as amended |

| |

Other Defined Terms: | | |

| |

Annual Meeting | | The 2018 Annual Meeting of shareholders of Green Plains Inc. and any adjournment or postponement thereof |

ASC 718 | | Accounting Standards Codification Topic 718, Compensation – Stock Compensation |

Board | | Board of Directors of Green Plains Inc. |

Common Stock | | Green Plains Inc. Common Stock, $0.001 par value per share |

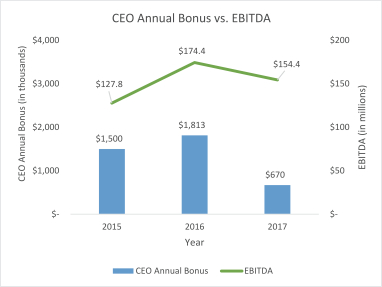

EBITDA | | Earnings before interest, taxes, depreciation and amortization which is anon-GAAP measure. See our Annual Report on Form10-K for the year ended December 31, 2017 for a reconciliation to GAAP net income |

ESG | | Environmental, social and governance |

GAAP | | U.S. Generally Accepted Accounting Principles |

GICS | | Global Industry Classification Standard |

GPP | | Green Plains Partners LP |

Internal Revenue Code | | Internal Revenue Code of 1986, as amended |

LTIP | | Long-Term Incentive Plan |

NEO | | Named executive officer |

Notice | | Important notice regarding the availability of proxy materials for the Annual Meeting |

PSU | | Performance Share Unit |

Record Date | | The record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting |

TCJA | | Tax Cuts and Jobs Act of 2017 |

TSR | | Total Shareholder Return |

Umbrella STIP | | Green Plains Inc. Umbrella Short-Term Incentive Plan |

U.S. | | United States5 |

PROXY SUMMARY

Proxy Statement

This Proxy Statement is provided to the shareholders of Green Plains Inc. in connection with the solicitation of proxies by our Board of Directors (the “Board”) to be voted at an Annual Meeting of Shareholders to be held at 10:00 a.m., Central Daylight Time, online at www.meetnow.global/MNVQDLQ on Tuesday, May 7, 2024, and at any adjournment or postponement thereof (the “Annual Meeting”).

Proxy Summary

This summary highlights selected information contained elsewhere in this Proxy Statement. This summary does not contain all

of the information that you should consider in deciding how to vote. You should read the Proxy Statement carefully before voting.

This Proxy Statement and the enclosed proxy is first being sent or made available to shareholders on or around March 29, 2018.2018 ANNUAL MEETING OF SHAREHOLDERS

Time and Date:

10:00 a.m., Central Standard Time, Wednesday, May 9, 2018

Place:

Omaha Marriott Downtown at the Capital District

222 N 10th Street, Omaha, Nebraska 68102

Record Date:March 15, 2018

VOTING INFORMATION

Who is Eligible to Vote

You are entitled to vote at the 2018 Annual Meeting of Shareholders if you were a shareholder of record as of the Record Date, which has been fixed as of close of business on March 15, 2018. On the Record Date, there were 40,931,456 shares of our company’s Common Stock outstanding and eligible to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter properly brought before the Annual Meeting.

The presence, in person or by properly executed proxy, at the Annual Meeting of the holders of a majority of the outstanding shares of Common Stock entitled to vote shall constitute a quorum. Proxies that are marked to “withhold authority” with respect to the election of directors and proxies for which no instructions are given will be counted for purposes of determining the presence of a quorum.

Electronic Access to Proxy Materials

Pursuant to rules adopted by the SEC, we are making this Proxy Statement and our 2017 Annual Report available to shareholders electronically via the Internet. On or around March 29, 2018, we mailed the Notice, which provides information regarding the availability of proxy materials for the Annual Meeting, to our shareholders of record.

Shareholders will be able to access this Proxy Statement and our 2017 Annual Report on the website referred to in the Notice or request to receive printed copies of the proxy materials. Instructions on how to access the proxy materials on the Internet or to request a printed copy may be found in the Notice. The website on which you will be able to view our proxy materials also allows you to choose to receive future proxy materials electronically by email, which would save us the cost of printing and mailing documents to you. If you choose to receive future proxy statements by email, you will receive an email next year with instructions containing a link to the proxy voting site. Your election to receive proxy materials by email remains in effect until you terminate it.

HOW YOU CAN ACCESS THE PROXY MATERIALS ONLINE

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 9, 2018.

The Notice, the Proxy and our 2017 Annual Report may be accessed at

www.edocumentview.com/GPRE.

MEETING AGENDA AND VOTING RECOMMENDATIONS

| | | | | | | | |

| About Our Company Transformation. It’s what we do every day when we convert a kernel of corn into sustainable products to help meet the global demand for high-value feed ingredients and low-carbon fuel. We are amid a broader transformation extracting even more low-carbon ingredients from the same annually renewable crops. Our suite of proprietary technologies makes our broad transformation possible. We are leading the way in producing sustainable ingredients to meet the demands of a growing world. Our transformation includes deploying our patented, world-class mechanical and process technology at each of our locations to develop nutritious, valuable ingredients that make a positive global impact. We are focused on reducing our operating expenses, expanding our ability to isolate the highest-value proteins for use in feed ingredients in pet, aquaculture and other high-value markets to meet global demand, converting a portion of the starch into low-carbon intensity dextrose—all while capturing more renewable corn oil from each kernel to serve as a feedstock for the rapidly expanding renewable diesel and sustainable aviation fuel markets. We have committed our seven biorefineries in Nebraska, Iowa, and Minnesota to carbon capture and sequestration projects. These projects will lower greenhouse gas emissions through the capture of biogenic carbon dioxide at each of these biorefineries, significantly lowering their carbon intensity. |

| | |

PROPOSAL

| | BOARD

RECOMMENDATION

| | PAGE

|

| | |

1. The election of four directors to serve three-year terms that expire at the 2021 annual meeting (“Proposal 1”)

| | FOR | | 11 |

| | |

2. An advisory vote to approve executive compensation (“Proposal 2”)

| | FOR | | 45 |

Proxy Voting and Revocability of Proxies

Common Stock, represented by the proxies received pursuant to this solicitation and not timely revoked, will be voted at the Annual Meeting in accordance with the instructions indicated in properly submitted proxies. If no instructions are indicated, such shares will be voted as recommended by the Board. If any other matters are properly presented to the Annual Meeting for action, the person(s) named in the enclosed form(s) of proxy and acting thereunder will have discretion to vote on such matters in accordance with their best judgment. Brokernon-votes and abstentions are not treated as votes cast for any of the matters to be voted on at the meeting.

A holder of Common Stock who has submitted a proxy may revoke it prior to its exercise by providing written notice of revocation or a later-dated proxy to the Corporate Secretary of the company at any time before the closing of the polls at the meeting, or by voting in person at the meeting. Any written notice revoking a proxy should be sent to: Green Plains Inc., Attention: Michelle S. Mapes, Corporate Secretary, 1811 Aksarben Drive, Omaha, Nebraska 68106. Attendance in person at the Annual Meeting does not itself revoke a proxy; however, any shareholder who attends the Annual Meeting may revoke a previously submitted proxy by voting in person.

Computershare Trust Company N.A. is the transfer agent and registrar for our Common Stock. If your shares are registered directly in your name with our transfer agent, with respect to those shares, you are considered the shareholder of record, or a registered shareholder, and these materials were sent to you directly by us. If you are a shareholder of record, you may vote in person at the Annual Meeting.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and that organization should have forwarded these materials to you. As the beneficial owner, you have the right to direct your broker, bank or nominee holding your shares how to vote and are also invited to attend the Annual Meeting. Please refer to the information forwarded by your broker or bank for instructions on how to direct their vote. However, since you are not a shareholder of record, you may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the shareholder of record.

If you are a registered shareholder, there are four ways to vote:

going to the Internet website indicated on the Proxy Card or voting instruction card and following the instructions provided (you will need the control number that is included in the Notice);Highlights

calling the toll-free telephone number indicated on the Proxy Card or voting instruction card (you will need the control number that is included in the Notice);

signing, dating and returning the Proxy Card if you request to receive your proxy materials by mail; or

written ballot in person at the Annual Meeting.

Your shares will be voted as you indicate. If you do not indicate your voting preferences, the appointed proxies will vote your shares “For” all nominees in Proposal 1, and “For” Proposal 2.

BrokerNon-Votes

Brokernon-votes occur when nominees, such as brokers and banks holding shares on behalf of the beneficial owners, are prohibited from exercising discretionary voting authority for beneficial owners who have not provided voting instructions at least ten days before the Annual Meeting date. If no instructions are given within that time frame, the nominees may vote those shares on matters deemed “routine” by the New York Stock Exchange. Onnon-routine matters, nominees cannot vote without instructions from the beneficial owner, resulting inso-called “brokernon-votes.” Brokernon-votes are not counted for the purposes of determining the number of shares present in person or represented by proxy on any voting matter. All proposals are considerednon-routine.

Expenses and Methods of Solicitation

We will bear the expense of soliciting proxies. In addition to the use of the mail and Internet, proxies may be solicited personally, or by telephone or other means of communications, by directors, officers and employees of the company and its subsidiaries who will not receive additional compensation therefor. We will reimburse banks, brokerage firms and nominees for reasonable expenses incurred related to forwarding proxy solicitation materials to beneficial owners of shares held by such banks, brokerage firms and nominees.

Vote Required

The affirmative vote of a plurality of the votes cast at the Annual Meeting by the holders of the Common Stock, assuming a quorum is present, is required to elect each director. The four persons receiving the greatest number of votes at the Annual Meeting shall be elected as directors. Since only affirmative votes count for this purpose, brokernon-votes or votes withheld will not affect the outcome of the voting on Proposal 1. The affirmative vote of a majority of the votes cast at the Annual Meeting by the holders of the Common Stock, assuming a quorum is present is required to approve Proposal 2. Since only votes cast count for this purpose, brokernon-votes and abstentions will not affect the outcome of the voting on Proposal 2.

BOARD HIGHLIGHTS

Our current directors whose terms are expiring have been nominated by the Board for reelection at the Annual Meeting. For more information on all of the director nominees, see page 12 of this Proxy Statement.

COMPANY HIGHLIGHTS

Our company is a vertically integrated commodity processing company and North America’s second largest consolidated owner of ethanol plants. The companyCompany operates fourthree business segments: (1) ethanol production, which includes the production of ethanol, distillers grains, Ultra-High Protein and renewable corn oil, (2) agribusiness and energy services, which includes grain handling and storage, andcommodity marketing and merchant trading for company-produced and third-party ethanol, distillers grains, renewable corn oil, natural gas and other commodities, (3) food and ingredients, which includes cattle feeding, vinegar production and food-grade corn oil operations, and (4)(3) partnership, which includes fuel storage and transportation services.

2017 PERFORMANCE HIGHLIGHTS

Fiscal 2017 presented

| | | | | |

| 6 | GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Transforming into the Biorefinery Platform of the Future

Green Plains is transforming from a challenging operating environment,traditional dry-mill ethanol producer into a sustainable biorefinery platform, innovating through ag-technology to produce higher-value products with stable cash flows, for tomorrow’s sustainable economy.

Investments in critical technology, infrastructure and strategic partnerships are driving progress to accelerate the transformation into the Biorefinery Platform of the Future.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| GREEN PLAINS 1.0 | TRANSFORMATION | GREEN PLAINS 2.0 | |

| | | Biorefinery Platform | |

| Ethanol DDGs Corn Oil | Strategic Partnerships MSCTM Technology Creates Ultra-High Protein and enhances Corn Oil yields Clean Sugar Technology™ | Ultra-High Protein DDGs Ethanol | Carbon Capture Renewable Corn Oil Dextrose | |

| | | | | |

| | | | | |

| | | | | |

Strategic Growth Areas

Verticals positioned to capitalize on rapidly growing demand.

| | | | | | | | | | | |

| Sustainable

Ultra-High Protein Sustainable ingredients for high-value global markets in pet, aquaculture, dairy and poultry industries as demand for higher quality animal feed grows. | | Renewable Corn Oil Responsible low-carbon feedstock for the high-growth renewable diesel and sustainable aviation fuel industries. |

| | | |

| Carbon Capture & Sequestration Participating in large scale CCS projects to further reduce the carbon intensity of our biofuels and ingredients. | | Clean Sugar Technology Low-carbon dextrose for a variety of biochemical, bioplastics, synthetic biology and food industries. |

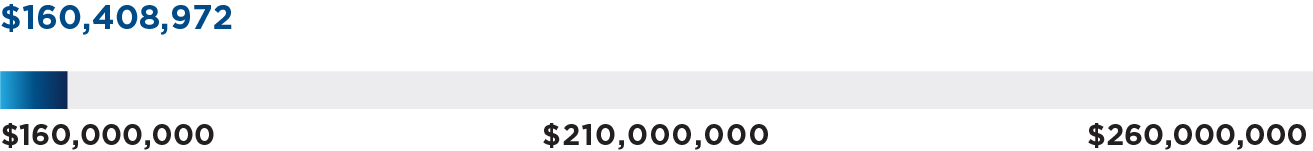

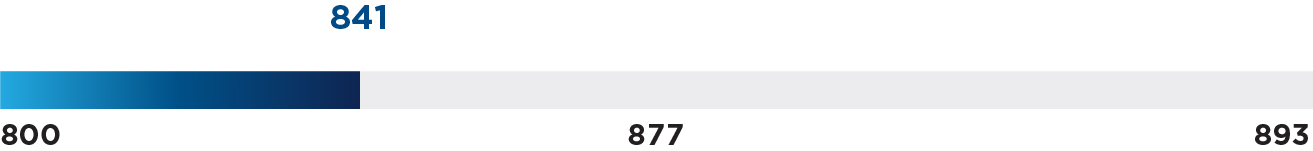

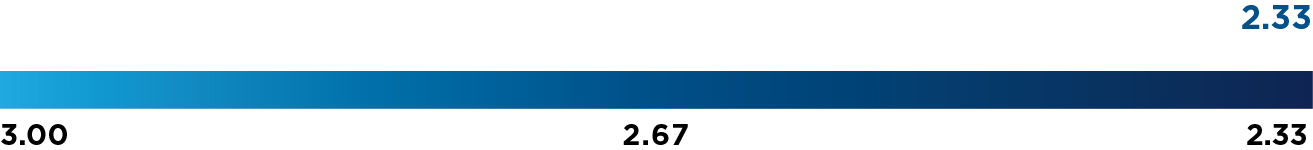

2023 Performance Highlights

Green Plains made significant progress across all aspects of our business experiencedtransformation in 2023, continuing the impactsdevelopment of 60% protein sales; deploying the first-of-its-kind commercial-scale dry mill Clean Sugar Technology™ facility at Green Plains Shenandoah to begin commissioning during the first quarter of 2024; reaching record yields of renewable corn oil; diversifying our decarbonization strategy alternatives by committing our three Nebraska, four Iowa and Minnesota facilities to carbon capture and sequestration (CCS) projects; and starting development of a continued deflationary cycle withinnovel Sustainable Aviation Fuel technology through a joint venture, Blue Blade Energy, with United Airlines and Tallgrass.

Through these accomplishments and many others from 2023, we continue the agriculture sectortransition into a sustainable, value-added ingredient producer that is less reliant on volatile commodities markets. We are expanding production of our high-value ingredients, attracting new partners and continued pricing pressure from increased global suppliesentering new markets.

Through our investments in innovation and technology, we are pursuing novel pathways to value creation for our shareholders, with a focus on managing risk and generating stable operating margins. We own and operate assets throughout the ethanol value chain: upstream, with grain handling and storage; through our ethanol production facilities; and downstream, with marketing and distribution services to reduce uncertainties.

| | |

|

Achievements —Began development of a novel Sustainable Aviation Fuel technology through a joint venture, Blue Blade Energy, with United Airlines and Tallgrass; —Successfully completed full scale 60% protein production runs using Fluid Quip Technologies’ MSC™ system combined with biological solutions; —Achieved record renewable corn oil yield across our platform; —First-ever commercial deployment of Clean Sugar Technology™ at Green Plains Shenandoah to begin commissioning during the first quarter of 2024; —Diversification of decarbonization strategy, with three Nebraska facilities committed to CCS anticipated to become operational in 2025, four Iowa and Minnesota facilities anticipated to be operational in 2026 on a separate CCS system; —Expanded protein sales to customers in North America, South America and Asia Pacific across multiple species; —Announced technology collaboration with Equilon Enterprises LLC to deploy Shell Fiber Conversion Technology; and —Completed acquisition of Green Plains Partners LP on January 9, 2024, with most of the efforts taking place during 2023. |

|

| | | | | |

| 8 | GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

Board Highlights

Our Board of

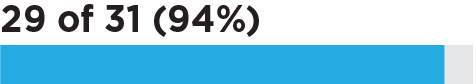

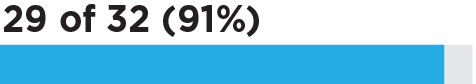

grains, proteins and oilseeds. As a result, and primarily due to weak ethanol margins, we did not achieve the EBITDA goal under our short-term incentive plan and our 2017 bonus payouts, for the NEOs that were employed for the entire year, ranged from 43% to 57% of each NEO’s target bonus.Despite these challenging operating conditions, we continued to execute on our business strategies by managing commodity price risks, improving operational efficiencies and optimizing market opportunities to create an efficient platform with diversified income streams, as exemplified by the following:

Key Operating Accomplishments

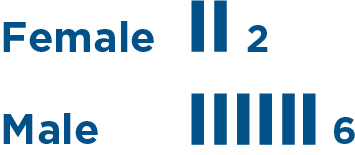

Directors | | | | | | | | | | | | | | | | | | | | |

| | | Director

Since | Committee

Membership |

| | | | | |

| Name and Primary Occupation | Age | AC | CC | NGC |

| | | | | | |

| Director Nominees |

| | | | | | |

| JAMES D. ANDERSON  Chairman of the Board Chief Executive Officer, Molycop | 66 | 2008 | | | |

| | | | | | |

| TODD A. BECKER President and Chief Executive Officer, Green Plains Inc. | 58 | 2009 | | | |

| | | | | | |

| EJNAR A. KNUDSEN III  Founder and Chief Executive Officer, AGR Partners | 55 | 2016 | | | |

| | | | | | |

| BRIAN PETERSON  President and Chief Executive Officer, Whiskey Creek Enterprises | 60 | 2005 | | | |

| | | | | | |

| ALAIN TREUER  Chairman and Chief Executive Officer, Tellac Reuert Partners and Chairman, Local Ocean France | 51 | 2008 | | | |

| | | | | | |

| KIMBERLY WAGNER  Founder, TBGD Partners | 60 | 2020 | | | |

| Continuing Directors with Terms Expiring in 2025 |

| | | | | | |

| FARHA ASLAM  Managing Partner, Crescent House Capital | 55 | 2021 | | |

|

| | | | | | |

| MARTIN SALINAS JR.  Former Chief Financial Officer, Energy Transfer Partners, LP | 52 | 2021 | | | |

| ◾ | | | | | | | | | | | | | | | | |

| | | | INDIndependent Director |

| Chair | | Net income of $61.1 million, or $1.47 per diluted share.Member | | ACAudit Committee | CCCompensation Committee |

| | | | NGCNominating and Governance Committee |

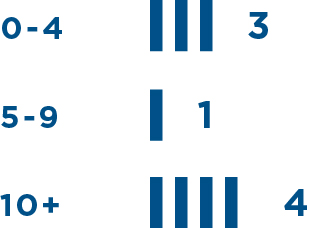

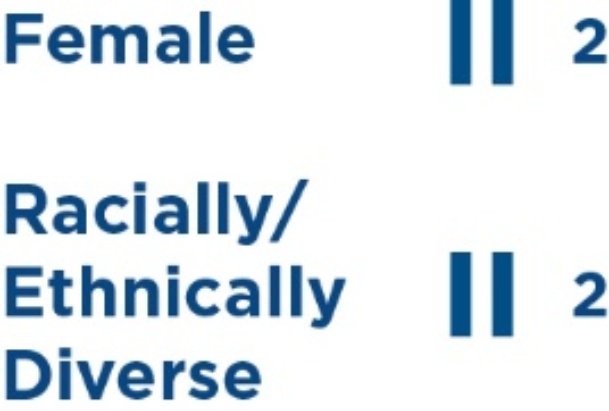

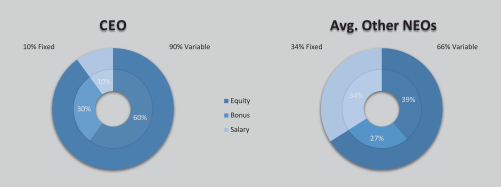

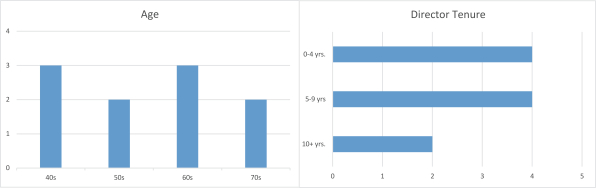

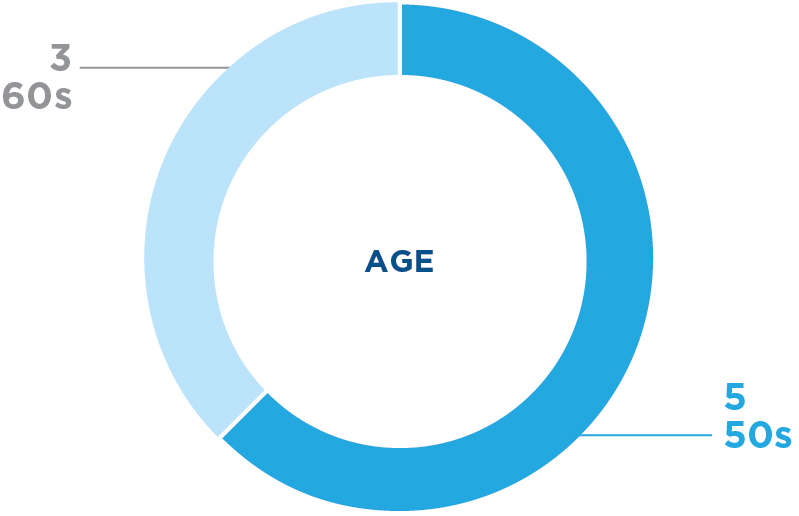

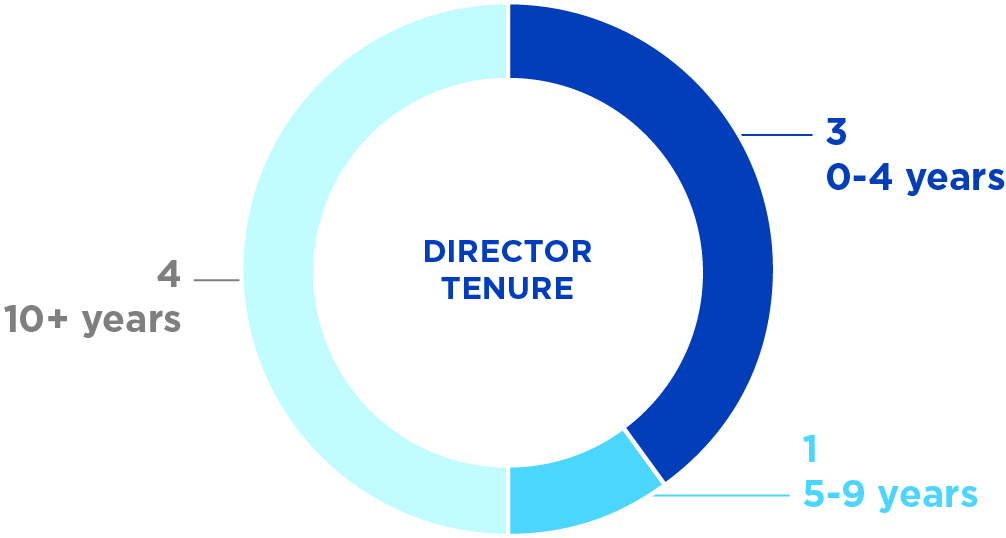

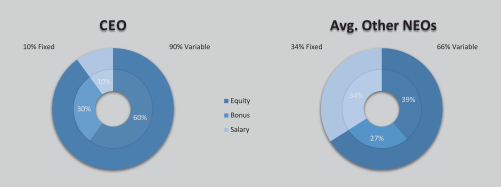

Board Snapshot

| | | | | | | | | | | | | | | | | |

| | | |

| INDEPENDENCE | Produced 1.3 billion gallonsAGE | DIRECTOR TENURE | DIVERSITY |

| | | |

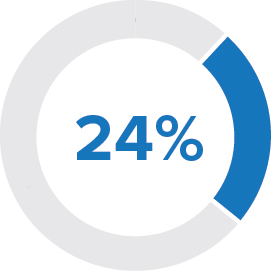

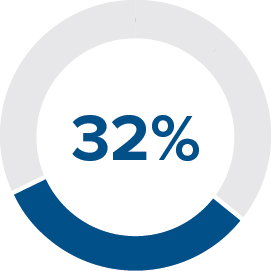

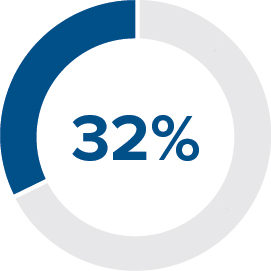

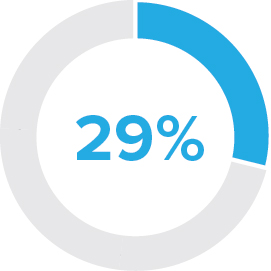

88% independent | 57 years average | 10.1 years average | 38% diverse |

| | | |

| | | |

| | | |

| | | 2/3 committee chairs are diverse |

| | | |

| | | |

| SKILLS AND EXPERIENCE | | |

| | | |

| EXECUTIVE

LEADERSHIP | | | INTERNATIONAL

BUSINESS | |

| | | | | |

| PUBLIC

COMPANY /CORP

GOVERNANCE/

ESG | | | MERGERS &

ACQUISITIONS | |

| | | | | |

| EXECUTIVE

COMPENSATION | | | CAPITAL

MARKETS | |

| | | | | |

| INDUSTRIAL MFG

& INGREDIENT

PROD | | | AUDIT/RISK/

CYBERSECURITY | |

| | | | | |

| COMMODITY

MARKETS/

MARKETING | | | LEGAL/

REGULATORY

GOVERNMENT

RELATIONS | |

| | | | | |

| STRATEGY

DEVELOPMENT | | | | |

| | | | | |

| | | | | |

| 10 | GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | |

| |

Key Skills &

Experiences | Description of Skills and Explanation of Importance |

| |

Executive

Leadership | —One of the core considerations of our Board in examining director candidates is that the director should have an established track record of professional accomplishment in the candidate’s chosen field. It is important we have highly qualified directors with a diverse range of complementary skill sets, but the common thread is that our directors have experience leading large, complex organizations and teams. Green Plains is a company with an array of important stakeholders, including employees, stockholders, customers, partners, regulators, and communities. It is important for our Board to have directors who have experience dealing with a similar range of stakeholders and managing the challenges associated with operating a large organization. |

| |

| |

Public

Company/

Corporate

Governance/

ESG | —Our Board is responsible for overseeing the successful execution of our strategy and the selection and retention of key executives, which affects the fundamental operation of the Company. It is important for our Board to have directors who understand the fiduciary obligations of public company directors and who have experience shaping a company’s priorities and structure. Effective corporate governance, ongoing board refreshment and a commitment to diversity are all part of a broader effort to ensure that ESG considerations and goals are incorporated into the company’s corporate strategy. Also, the implementation of leading ESG practices is a very important component of our business as the effects of global climate change continues to attract considerable attention with widespread concerns about the impacts of human activity, especially the emissions of greenhouse gases. |

| |

| |

Executive

Compensation | —The Board believes that aligning executive compensation with shareholder interests is consistent with the Company’s philosophy of driving performance and building long-term shareholder value. This pay-for-performance philosophy is embraced by the Board and is intended to align the interests of key executives, attract and retain high-performing employees, and link a significant amount of compensation to the achievement of pre-established performance metrics directly tied to our business goals and strategies. It is important for Green Plains to have board members who have participated in the design and supervision of executive compensation programs. |

| |

| |

Industrial

Manufacturing

& Ingredient

Production | —Green Plains has grown to be one of the leading corn processors in the world for low-carbon products at our biorefineries, inclusive of ethanol, renewable corn oil, Ultra-High Protein, and distillers grains as our core sources of revenue. We operate 10 biorefineries located in six states. It is important for our Board to have a 9.5% increase over 2016.deep understanding of industrial manufacturing, the biorefinery and the proprietary and patented protein production processes, as well as potential future technologies applicable to our biorefineries. |

| |

| |

Commodity

Markets/

Marketing | —Green Plains procures grain and natural gas to produce our products and markets, sells and distributes our products, e.g., ethanol, distillers grains, Ultra-High Protein, and renewable corn oil produced at our biorefineries. A strong understanding of commodity markets is essential as well as an understanding of U.S. and global markets impacting supply and demand characteristics. |

| |

| ◾ | | | | |

| |

Strategy

Development | | EBITDA of $154.4 million (see EBITDA reconciliation—We believe that we can maximize our competitive advantage to create lasting value for our stockholders, both in the company’s Form10-K, filed February 14, 2018).near and longer-term, by successfully executing on our strategic plan, to take advantage of the world’s growing demand for protein feed ingredients. It is important for our Board to have directors who have experience developing, delivering and directing corporate strategy. Further, it is important to have board members who have experience transforming organizations and culture and improving processes, services, and products with an aim of enhancing long-term value. |

| ◾ |

| |

International

Business | —Global competition, international trade and product-related policies, and international activities can have a significant impact on our business. |

| |

| |

Mergers &

Acquisitions /

Partnerships | With weaker ethanol margins during fiscal year 2017, we—Joint ventures, partnerships, mergers and acquisitions are an important part of maintaining a competitive advantage by maximizing our production capabilities, leveraging our proprietary technology and expanding new products into fast-growing, higher margin markets. We intend to continue exploring potential growth opportunities and strategies through these disciplines. As such, it is important to have board members well-versed in M&A-related activities to ensure that the right opportunities are being pursued, operational and financial risks can be quantified and effectively managed while expected synergies and growth projections are reasonable and realistic. |

| |

| |

Capital

Markets | —As our company continues to transform, having expertise in capital markets and various equity and debt financing alternatives will continue to managebe a critical skill set for our ethanol productionBoard to ensure we have the optimal capital structure, and financing needed to support these efforts. |

| |

| |

Audit/Risk/

Cybersecurity | —As a public company, we are subject to various auditing, accounting, and financial reporting obligations. Our Audit Committee’s responsibilities include reviewing the Company’s financial statements, financial reporting, and internal controls, as well poised as both domesticoverseeing the independent auditor and global demand continuescybersecurity. Green Plains is also subject to rise.various forms of risk, including, without limitation, cybersecurity risk, liquidity risk, credit risk, market risk, interest rate risk, operational risk, legal and compliance risk and reputational risk. It is important for our Board to have directors who are financial experts and who understand financial reporting as well as effective risk management practices. |

Growth Achievements

| ◾ |

| |

Legal/

Regulatory/

Government

Relations | | Completed acquisitions of cattle-feed—Our operations located in Hereford, Texas, Leoti, Kansas and Eckley, Colorado bringing the company’s total capacityare regulated by various government entities that can impose significant costs on our business. It is important to 258,000 head of cattle and making us the 4th largest feedlot operator in the U.S. |

◾ | | Along with our joint-venture partner, Jefferson Gulf Coast Energy Partner’s, commenced commercial operations at the intermodal export and import fuels terminal in Beaumont, Texas. |

◾ | | Entered intohave board members who have a $500 million term loan agreement, which matures on August 29, 2023, to refinance $405 million of existing debt. |

◾ | | Repurchased $6.7 millionstrong comprehension of the company’s Common Stock pursuantlegal and regulatory landscape specific to our stock repurchase program.business. Our production levels, markets and grain we procure are affected by federal government programs. Government policies such as tariffs, duties, subsidies, import and export restrictions and embargoes can also impact our business. |

| |

| | | | | |

| 12 | GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

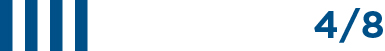

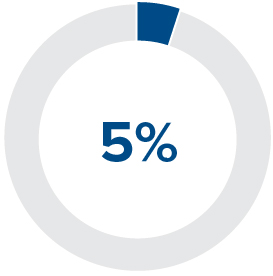

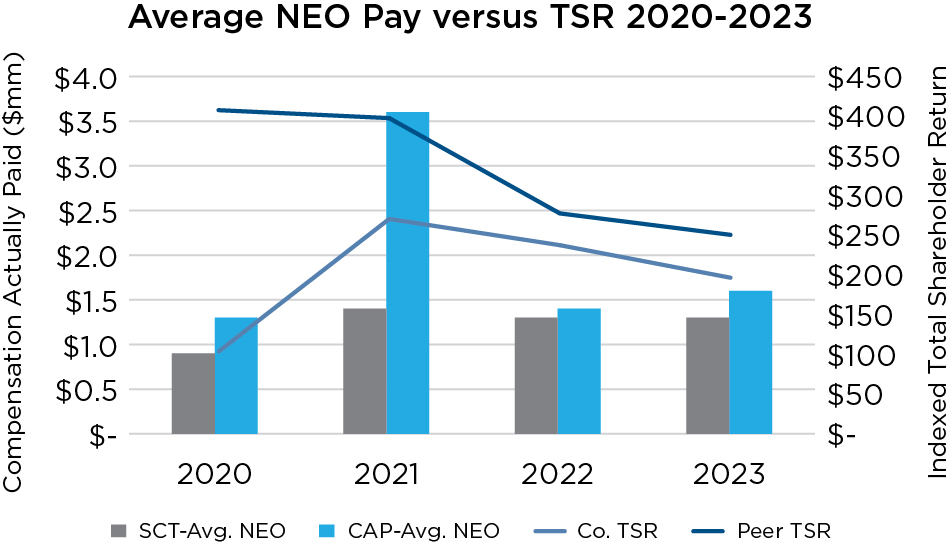

EXECUTIVE COMPENSATION HIGHLIGHTS

Compensation Philosophy.

Corporate Governance Highlights

Our

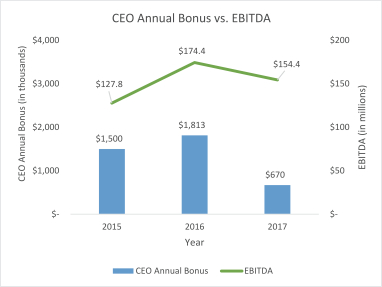

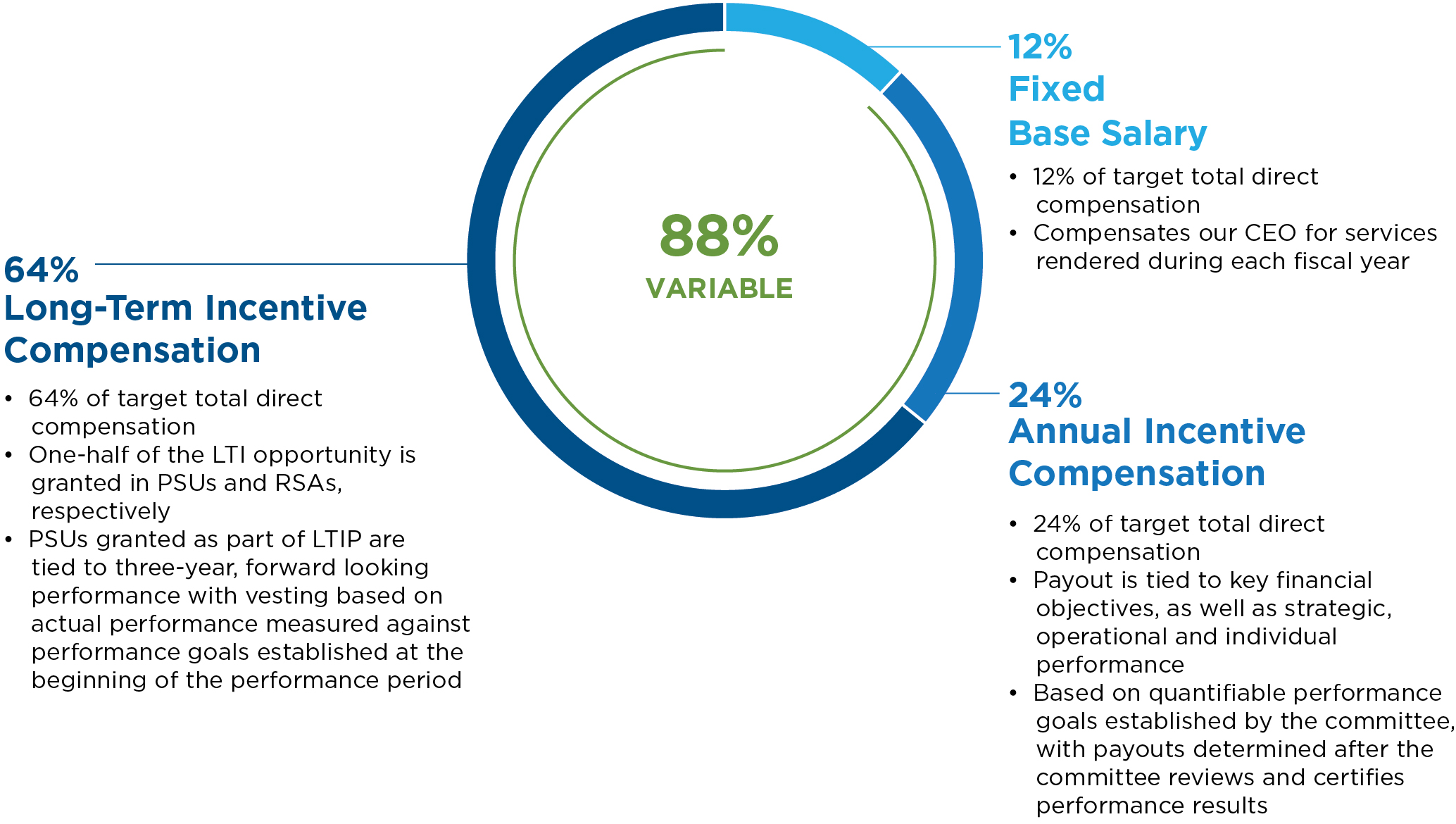

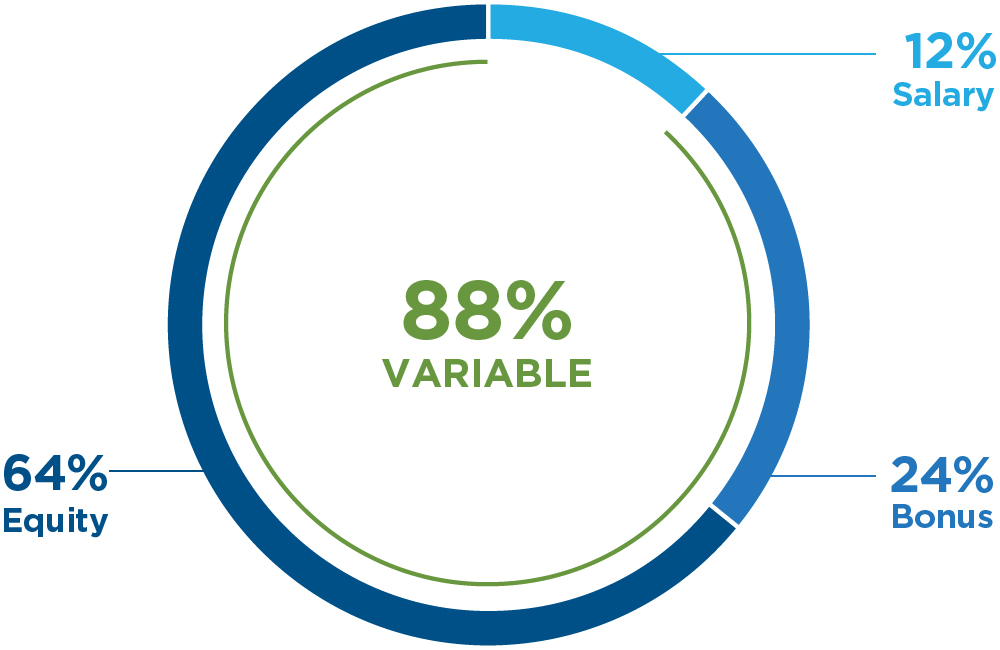

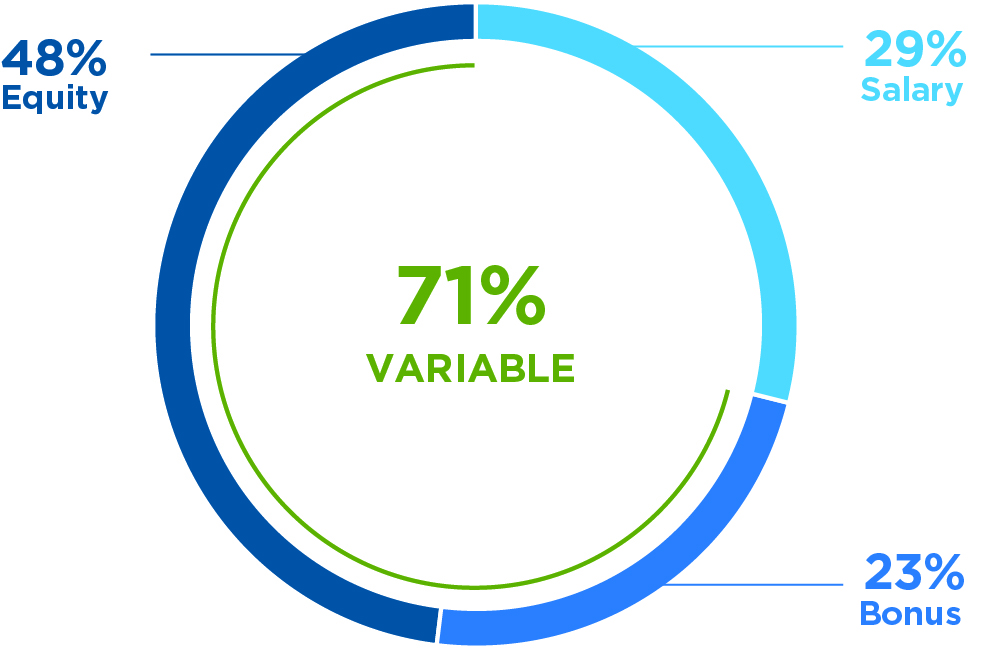

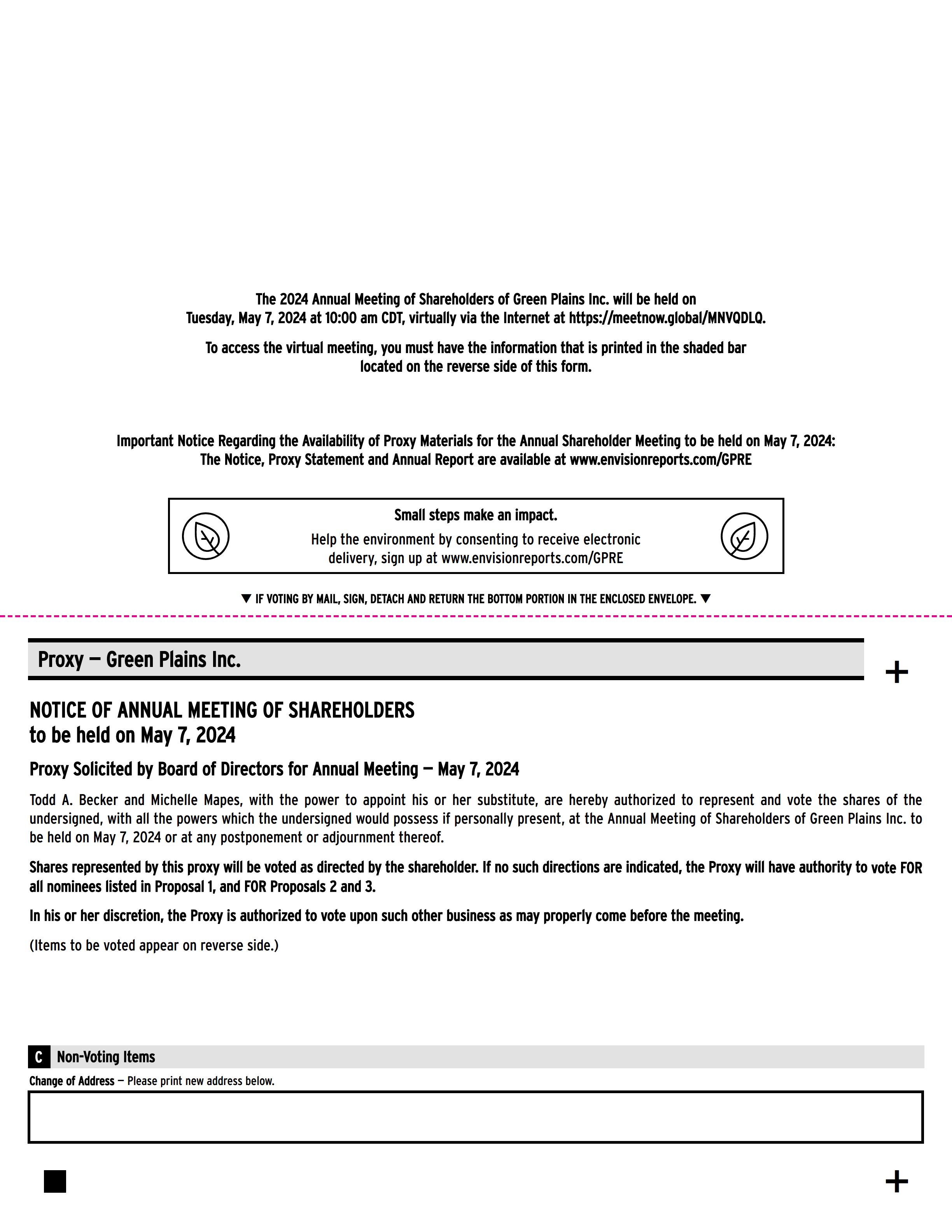

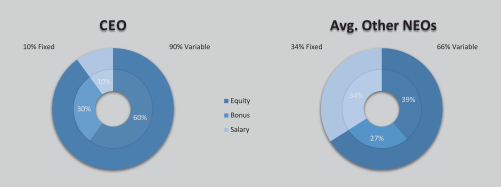

Compensation Committee has designed our executive compensation program to deliver pay that reflects corporate, business unit and individual performance that also aligns with the creation of long-term value for our shareholders. As part of our compensation philosophy we pay executive salaries that are lower than our competitors, with more compensation“at-risk” through long-term equity awards and annual cash incentive awards. Our annual cash incentive plan provides an incentive to achieve financial and operational performance aligned with our business plan and longer term strategy.The following chart illustrates the mix of total direct compensation elements for our NEO’s at target performance, excluding our former Chief Financial Officer who retired during fiscal 2017.

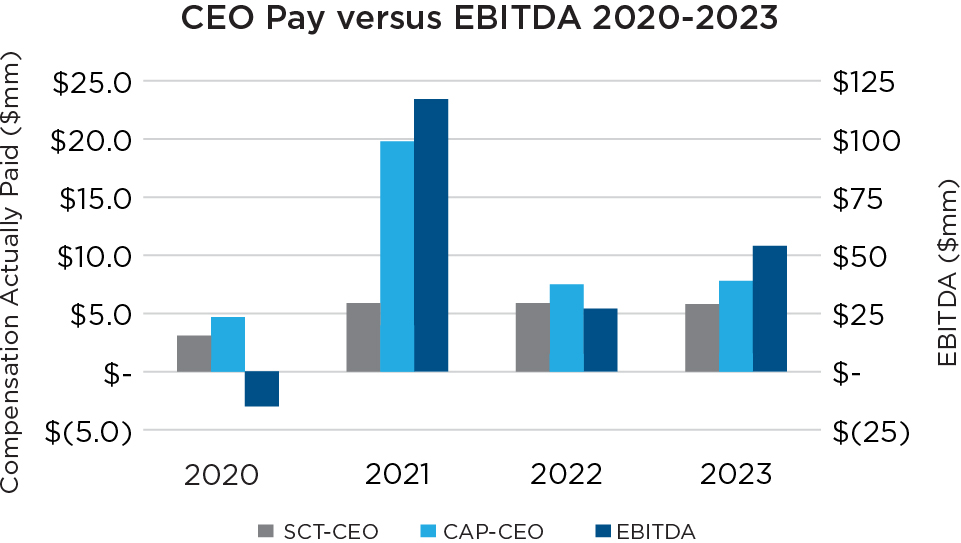

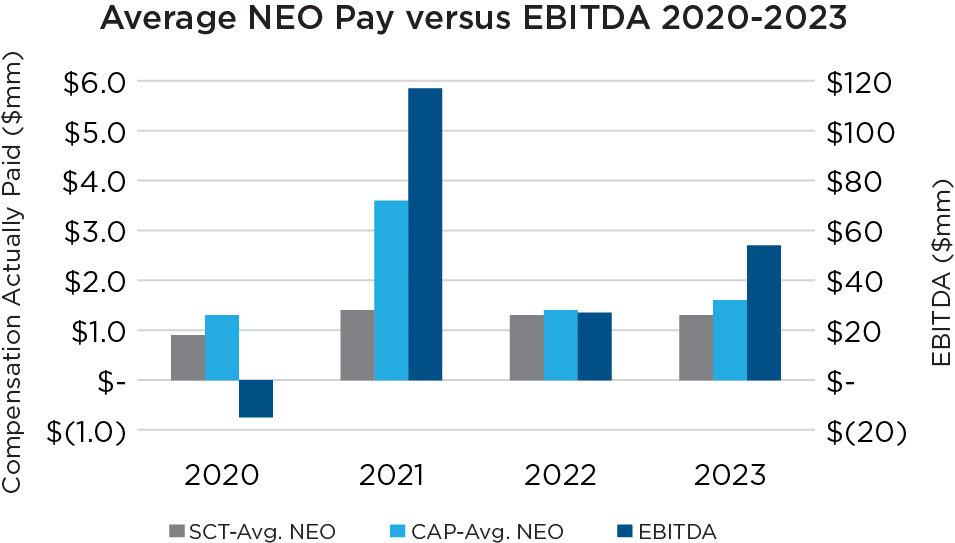

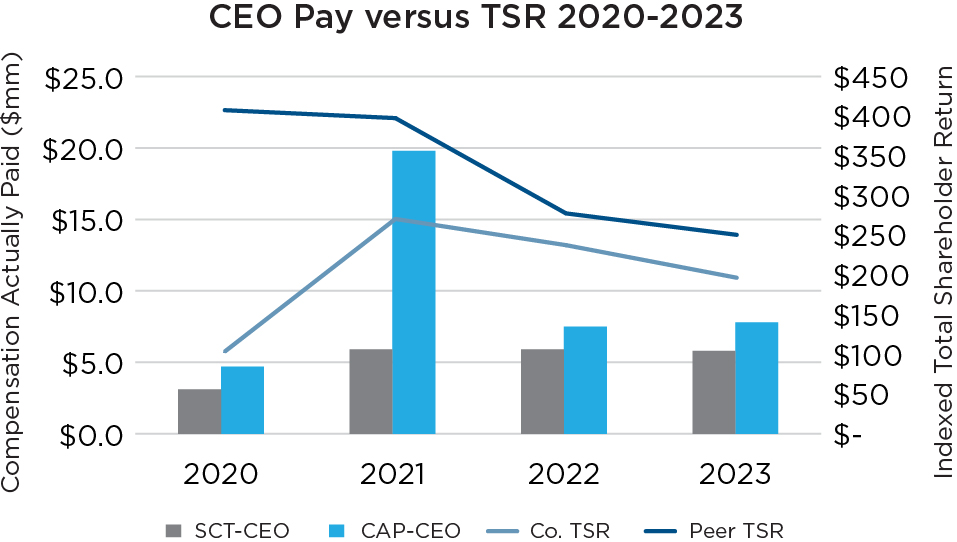

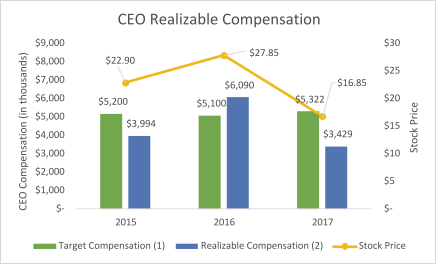

Pay for Performance. Our Compensation Committee has designed our executive compensation program to deliver pay in alignment with corporate and individual performance, aligned with our strategy of growing ethanol andnon-ethanol EBITDA, while operating safely and delivering an appropriate level of return to our shareholders.

Performance againstpre-established EBITDA goals is a key element of our annual incentive plan. Historically, we have used key acquisitions to transform our platform and build future value through continued vertical integration. As the chart on page 20 indicates, our CEO’s total realizable compensation is well-aligned with our company and stock price performance.

Our Compensation Committee believes that our executive compensation program effectively aligns executive pay with performance returns to shareholders and creates a growth-oriented, long-term value proposition for our shareholders. For more information, see “Compensation Discussion and Analysis – Executive Overview – Pay for Performance” included in the Proxy Statement.

Response to Say On Pay Vote and Changes to our Executive Compensation Program. At our 2017 annual meeting, our shareholders approved our NEOs’ compensation, with approximately 76% of the votes cast in favor of our say on pay proposal.

The committee, with input from its independent compensation consultant, considered the 2017 vote results, shareholder input and current market practices as it evaluated whether changes to the compensation program were warranted for 2018.

Based on shareholder input and to better align our compensation programs with our strategy and market practice, we implemented the following changes for 2018:

We transitioned our long-term incentive program to a forward looking program, with awards contingent on future performance;

| • | | Beginning in 2018, one half of awards to executive officers under the LTIP will be in the form of performance share units (PSUs) which vest based 1⁄2 on total shareholder return relative to a performance peer group and 1⁄2 based on return on net assets; |

We have adjusted our Chief Executive Officer’s salary and target annual incentive for 2018 to align more closely with market norms, increasing salary, but maintaining a salary below market median and decreasing his target annual incentive to 200% of salary, to maintain his target cash compensation at the same level as in 2017;

We adopted a compensation recovery (clawback) policy to all the Board to recoup incentive compensation in appropriate circumstances;

We have eliminated the excise tax gross up provision in our Chief Executive Officer’s employment agreement; and

The Compensation Committee retained an independent compensation advisor to provide advice in connection with our executive compensation program and incentive plan design.

The Compensation Committee believes these changes will strengthen alignment between executive compensation and the interests of our shareholders, and support the achievement of our strategic and financial goals. For a more detailed discussion of these changes, please see “Compensation Discussion and Analysis” beginning on page 16 of this Proxy Statement.

GOVERNANCE HIGHLIGHTS

Our companyCompany has a history of strong corporate governance. By evolving our governance approach in light ofconsidering best practices, our Board drives sustained shareholder value and best serves the interests of our shareholders.

| | | | | | | | | | | |

| | | |

What We Do | | | What We Don’t Do |

| | |

|

| WHAT WE DO | | WHAT WE DON’T DO |

| | | |

✓

100% independent board committees 100% independent board committees | | Ï No poison pill

|

| |

✓

100% directors owning stock 100% directors owning stock Compensation recoupment (clawback) policy Compensation recoupment (clawback) policy Right to call special meeting threshold set at 20% Right to call special meeting threshold set at 20% Provide a majority of executive compensation in performance-based compensation Provide a majority of executive compensation in performance-based compensation Pay for performance based on measurable goals for both annual and long-term awards Pay for performance based on measurable goals for both annual and long-term awards Balanced mix of awards tied to annual and long-term performance Balanced mix of awards tied to annual and long-term performance Stock ownership and retention policy Stock ownership and retention policy | | | Ï

No poison pills No poison pills No supplemental executive retirement plans No supplemental executive retirement plans |

| |

✓ Compensation recoupment (clawback) policy

| | Ï

No discounted stock options, reload of stock options or stock optionre-pricing without shareholder approval No discounted stock options, reload of stock options or stock optionre-pricing without shareholder approval |

| |

✓ Right to call special meeting threshold set at 10%

| | Ï

No single-trigger vesting of equity compensation upon a change in control No single-trigger vesting of equity compensation upon a change in control |

| |

✓ Provide a majority of executive compensation in performance-based compensation

| | Ï

No short-term trading, short sales, transactions involving derivatives, hedging or pledging transactions for executive officers and directors No short-term trading, short sales, transactions involving derivatives, hedging or pledging transactions for executive officers and directors |

| | | |

| | | | | | | | | | | |

| | |

| Corporate Governance Improvements | |

| | | |

| | | |

| 2020 | —Appointed diverse director | |

| | | |

| | | |

| 2021 | —Appointed two additional diverse directors —Appointed Lead Independent Director —Published governance guidelines with independent executive sessions —Reviewed broadening scope for cyber and ESG oversight by annual charter —Updated bylaws for proxy access and majority voting standard —Lowered threshold for special meeting to 20% —Rotated Committee chairs with two of the three Committee chairs diverse —Proposed reduction of the board from nine to eight members by no later than the 2023 annual meeting | |

| | | |

| | | |

| 2022 | —Recommended and declassified the board of directors | |

| | | |

| | | |

| 2023 | —Appointed Independent Chairman of the Board to replace the Lead Independent Director position —Downsized to eight directors, fulfilling commitment made to investors in 2021 | |

| | | |

Environmental Stewardship and Social Responsibility Highlights

Green Plains has transformed our business model to deliver on the rapidly expanding opportunities and crucial benefits of the emerging bioeconomy. We develop and increase renewable processes and products across our sustainable ingredients portfolio, and continue to enrich our social and governance foundations, in order to innovate solutions for a far-reaching set of stakeholders and our shared natural environment. Below are some highlights reflecting the impact we have in Environmental Stewardship and Social Responsibility.

| | | | | |

| |

Environmental Stewardship As an ag-tech innovator of sustainable ingredients that matter, Green Plains is dedicated to preserving the health of our planet for current and future generations. | —Notable 2023 achievements in this area included: —Leveraged innovative technologies and partnerships to further decarbonize our platform. —Made significant progress in goals related to energy efficiency, water management and sustainable sourcing. —Diversification of decarbonization strategy, with three Nebraska facilities committed to CCS anticipated to become operational in 2025, four Iowa and Minnesota facilities anticipated to be operational in 2026 on a separate CCS system. —Achieved record renewable corn oil yield across our platform. |

| ✓ Pay for performance based |

| |

Social Responsibility Green Plains recognizes the value of all who make our success and our sustainable ingredients possible. We endeavor to support and empower our employees, customers, suppliers and communities in all that we do. | —Notable 2023 achievements in this area included: —Enhanced an array of employee programs. —Completed training on measurable goals for both annualpatented technologies. —Made high-value capital investments in our local communities. —Saw further improvement in our OSHA recordable injury rate, achieving a 56% reduction in 2023 over our 2020 baseline and long-term awards | | exceeding our goal of a 35% reduction by 2025. |

| |

| | | | | |

✓ Balanced mix of awards tied to annual and long-term performance

14 | | |

| |

✓ Stock ownership and retention policy

| | GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

PROXY STATEMENT

FOR AN ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 2018

This Proxy Statement is provided to the shareholders of Green Plains Inc. in

connection with the solicitation of proxies by our Board of Directors (the “Board”)

to be voted at an Annual Meeting of Shareholders to be held at the 10:00 a.m.,

Central Standard Time, at the Omaha Marriott Downtown at the Capital District

located at 222 N 10th Street, Omaha, Nebraska 68102, on Wednesday, May 9,

2018, and at any adjournment or postponement thereof (the “Annual Meeting”).

This Proxy Statement and the enclosed proxy is first being sent or made

available to shareholders on or around March 29, 2018. This Proxy Statement

provides information that should be helpful to you in deciding how to vote on the

matters to be voted on at the Annual Meeting.

We are asking you to elect the four nominees identified in this Proxy Statement

as directors of GPI until the 2021 annual meeting of shareholders and to vote to

approve, on an advisory basis, our executive compensation.

Corporate GovernanceCORPORATE GOVERNANCE

In accordance with the General Corporation Law of the State of Iowa, our restated certificateThird Articles of incorporation,Amendment to Second Amended and Restated Articles of Incorporation, as amended (our “Charter”), and our amendedFifth Amended and restated bylaws,Restated Bylaws (“Bylaws”), our business, property and affairs are managed under the direction of the Board.

Independent Directors

Under the corporate governance listing standards of the NASDAQ and our committee charters, the Board must consist of a majority of independent directors. In making independence determinations, the Board observes NASDAQ and Securities and Exchange Commission (“SEC”) criteria and considers all relevant facts and circumstances. The Board, in coordination with its Nominating and Governance Committee, annually reviews all relevant business relationships any director nominee may have with our Company. As a result of its annual review, the Board has determined that each of its currentnon-employee directors meet the independence requirements of the NASDAQ and the SEC.

Meetings of the Board

During the fiscal year ended December 31, 2017, the Board held four regular meetings and two special meetings. Each of the serving directors attended at least 83% of all meetings held by the Board and at least 87.5% of each committee meeting of the Board on which the applicable director served during the fiscal year ended December 31, 2017. The Board and committees met in executive session, without management at each meeting.

The table below shows the meeting attendance for each director in 2017.

| | | | | | | | | | | | | | | | | | | | | | | | | |

NAME | | Board | | Audit Committee | | Compensation

Committee | | Nominating and

Governance

Committee | | Overall Attendance |

| | | | | |

Wayne Hoovestol, Chairman

| | 6 of 6 | | - | | - | | - | | 6 of 6 (100%) |

| | | | | |

Jim Anderson

| | 5 of 6 | | 7 of 8 | | 11 of 11 | | - | | 23 of 25 (92%) |

| | | | | |

Todd Becker

| | 6 of 6 | | - | | - | | - | | 6 of 6 (100%) |

| | | | | |

James Crowley

| | 6 of 6 | | 8 of 8 | | - | | - | | 14 of 14 (100%) |

| | | | | |

Gene Edwards

| | 6 of 6 | | 8 of 8 | | 10 of 11 | | - | | 24 of 25 (96%) |

| | | | | |

Gordon Glade

| | 6 of 6 | | 8 of 8 | | - | | 4 of 4 | | 18 of 18 (100%) |

| | | | | |

Ejnar Knudsen

| | 6 of 6 | | 8 of 8 | | - | | - | | 14 of 14 (100%) |

| | | | | |

Thomas Manuel

| | 6 of 6 | | - | | 11 of 11 | | 4 of 4 | | 21 of 21 (100%) |

| | | | | |

Brian Peterson

| | 6 of 6 | | - | | - | | 4 of 4 | | 10 of 10 (100%) |

| | | | | |

Alain Treuer

| | 5 of 6 | | - | | 11 of 11 | | 4 of 4 | | 20 of 21 (95%) |

Communications with the Board

Shareholders and other interested parties who wish to communicate with the Board as a whole, or with individual directors, may direct any correspondence to the following address: c/o Corporate Secretary, Green Plains Inc., 1811 Aksarben Drive, Omaha, Nebraska 68106. All communications sent to this address will be shared with the Board, or the Board Chairman or any other specific director, if so addressed.

It is a policy of the Board to encourage, but not require, directors to attend each annual meeting of shareholders. The Board’s attendance allows for direct interaction between shareholders and members of the Board. All of our directors, with the exception of one, attended our 2017 annual meeting of shareholders.

The Board’s Role in Risk Oversight

The Board and each of its committees are involved in overseeing risk associated with our company. In its oversight role, the Board annually reviews our company’s strategic plan, which addresses, among other things, the risks and opportunities facing our company. While the Board has the ultimate oversight responsibility for the risk management process, it has delegated certain risk management oversight responsibilities to the Board committees.

One of the primary purposes of the Audit Committee, as set forth in its charter, is to act on behalf of the Board in fulfilling its responsibilities to oversee company processes for the management of business/financial risk and for compliance with applicable legal, ethical and regulatory requirements. Accordingly, as part of its responsibilities as set forth in its charter, the Audit Committee is charged with (i) inquiring of management and our company’s outside auditors about significant risks and exposures and assessing the steps management has taken or needs to take to minimize such risks and (ii) overseeing our company’s policies with respect to risk assessment and risk management, including the development and maintenance of an internal audit function to provide management and the Audit Committee with ongoing assessments of our company’s risk management processes and internal controls. In connection with these risk oversight responsibilities, the Audit Committee has regular meetings with our company’s management, internal auditors and independent, external auditors.

The Nominating and Governance Committee annually reviews our company’s corporate governance guidelines and their implementation, as well as regularly evaluates new and continuing directors for election to the Board. The Compensation Committee considers risks related to the attraction and retention of talented senior management and other employees as well as risks relating to the design of compensation programs and arrangements. Each committee provides the Board with regular, detailed reports regarding committee meetings and actions. In addition, our company employs an Executive Vice President – Risk who reports directly to our CEO with respect to risk management and provides regular updates and reports to our CEO and Board regarding all of our company’s commodity risk positions.

Committees of the Board

The Board has a standing Audit Committee, Compensation Committee, and Nominating and Governance Committee, each of which has a charter setting forth its responsibilities. Board members also possess key knowledge and skills as noted in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Skill

| | Jim

Anderson | | Todd

Becker | | James

Crowley | | Gene

Edwards | | Gordon

Glade | | Wayne

Hoovestol | | Ejnar

Knudsen | | Thomas

Manuel | | Brian

Peterson | | Alain

Treuer |

Executive

Management

| | x | | x | | x | | x | | x | | x | | x | | x | | x | | x |

Finance /

Financial

Expert

| | x | | x | | x | | x | | x | | | | x | | x | | | | x |

Compensation

| | x | | x | | x | | x | | | | x | | | | x | | | | x |

Risk

Management

| | x | | x | | x | | x | | | | x | | x | | x | | x | | x |

Industry

Knowledge

| | x | | x | | | | x | | x | | x | | x | | x | | x | | x |

Technology

| | | | x | | | | x | | | | | | | | x | | | | x |

Government

Relations

| | x | | x | | x | | x | | | | x | | | | x | | | | |

Accounting

| | x | | x | | x | | x | | x | | | | x | | x | | | | |

Legal /

Regulatory

| | | | x | | | | x | | | | | | | | x | | | | |

International

Business

| | x | | x | | x | | | | | | | | x | | x | | | | x |

Strategy

Development

| | x | | x | | x | | x | | | | x | | x | | x | | | | x |

Mergers &

Acquisitions

| | x | | x | | x | | x | | x | | x | | x | | x | | | | x |

Corporate

Governance

| | x | | x | | x | | x | | x | | | | | | x | | x | | x |

The tables which follow set forth committee memberships as of the date of this proxy.

|

AUDIT COMMITTEE |

The Audit Committee, which was established in accordance with section 3(a)(58)(A) of the Exchange Act, currently consists of Messrs. Crowley (Chairman), Anderson, Edwards, Glade and Knudsen, each of whom is independent under the rules of the NASDAQ and the SEC. Mr. Crowley has been determined to be an audit committee financial expert as defined in Rule 407(d)(5) of RegulationS-K. The Audit Committee continued its standing practice of meeting directly with our internal audit staff to discuss the current year’s audit plan and to allow for direct interaction between the Audit Committee members and our internal auditors. The Audit Committee also meets directly with our independent auditors. The Audit Committee met eight times during the fiscal year ended December 31, 2017. During each of these meetings, the Audit Committee met directly with our independent auditors.

The function of the Audit Committee, as detailed in its charter and available on the company’s website, is to provide assistance to the Board in fulfilling its responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices, and the quality and integrity of our financial reports. In doing so, it is the responsibility of the Audit Committee to maintain free and open means of communication between the directors, the independent auditors and our management.

|

Please see page 47 of this Proxy Statement for the “Report of the Audit Committee.”

| | | | | | | | | | | | | | | | | |

| COMPENSATION COMMITTEE | | Proposal 1 | | |

| The Compensation Committee currently consists | | | |

| | | Election of Messrs. Treuer (Chairman), Anderson, Edwards and Manuel,Directors | |

| | | | |

| | | | |

| | | To be elected, each nominee for director must receive a plurality of whom is independent under the rules of the NASDAQ and the SEC. The Compensation Committee met 11 times during the fiscal year ended December 31, 2017.The Compensation Committee establishes our general compensation policy and, except as prohibited by law, may take any and all actions that the Board could take relating to compensation of directors, executive officers, employees and other parties. The Compensation Committee’s role is to (i) evaluate the performance of our executive officers, (ii) set compensation for directors and executive officers, (iii) make recommendations to the Board on adoption of compensation plans and (iv) administer our compensation plans, including choosing performance measures, setting performance targets and evaluating performance, in consultation with the Chief Executive Officer. When evaluating potential compensation adjustments, the Compensation Committee solicits and considers input providedvotes cast by the Chief Executive Officer relatingshares of Common Stock present in person (online) or represented by proxy and entitled to the individual performance and contribution to our overall performance by executive officers (other than himself) and other key employees.

As permitted by the Compensation Committee Charter, whichvote (assuming a quorum is available on the company’s website, the Compensation Committee retained the services of an independent compensation adviser to provide consulting servicespresent) with respect to the company’s executive compensation program. In December 2017, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”)that nominee’s election. Abstentions and broker “non-votes” will not be counted as its compensation adviser for the remainder of fiscal 2017 and fiscal 2018. Pursuant to the terms of its engagement by the Compensation Committee, in 2017 and early 2018, Meridian provided advice regarding our executive compensation programs in relation to the objectives of those programs and provided information and advice on competitive compensation practices and trends, along with specific views on our executive compensation programs. In its role as the Committee’s independent compensation consultant, representatives of Meridian engaged in discussions with the Compensation Committee and responded on a regular basis to questions from the Committee, providing them with their opinionsvote cast "for" or "against" with respect to the design of current or proposed compensation programs. During fiscal 2017, Meridian reported directly to the Compensation Committee and the Committee retained the sole authority to retain or terminate their services.

a nominee. |

Please see page 31 of this Proxy Statement for the “Compensation Committee Report.”

|

| NOMINATING AND GOVERNANCE COMMITTEE | | | |

| | |

The Nominating and Governance Committee currently consists of Messrs. Peterson (Chairman), Glade, Manuel and Treuer, Board recommends that stockholders vote “FOR”each of whom is independent under the rules of the NASDAQ and the SEC. The Nominating and Governance Committee met four times during the fiscal year ended December 31, 2017.The function of the Nominating and Governance Committee, as detailednominees set forth in its charter and available on the company’s website, is to recommend to the Board the slate of director nominees for election to the Board, to identify and recommend candidates to fill vacancies occurring between annual shareholder meetings, and to review and address governance items. The Nominating and Governance Committee has established certain broad qualifications in order to consider a proposed candidate for election to the Board. The Nominating and Governance Committee will also consider such other factors as it deems appropriate to assist in developing a Board and committees that are diverse in nature and comprised of experienced and seasoned advisors. These factors include judgment, skill, diversity (such as race, gender or experience), integrity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board.

Proposal 1. | |

| | | | | |

Code of Ethics

The Board

has adopted a Code of Ethics to which all officers, directors and employees, who for purposes of the Code of Ethics are collectively referred to as employees, are required to adhere in addressing the legal and ethical issues encountered in conducting their work. The Code of Ethics requires that all employees avoid conflicts of interest, comply with all laws, rules and regulations, conduct business in an honest and fair manner, and otherwise act with integrity. Employees are required to report any violations of the Code of Ethics and may do so anonymously by contacting https://gpreinc.alertline.com. The Code of Ethics includes specific provisions applicable to the company’s principal executive officer and senior financial officers. The full text of the code of ethics is published on our website in the “Investors – Corporate Governance” section.The Board also has adopted a Related Party Policy which addresses our company’s procedures with respect to the review and approval of “related party transactions” that are required to be disclosed pursuant to SEC regulations. The Code of Ethics provides that any transaction or activity in which the company is involved with a “related party” (which is defined as an employee’s child, stepchild, parent, stepparent, spouse, sibling,mother-in-law,father-in-law,son-in-law,daughter-in-law,brother-in-law, orsister-in-law, or any person (other than a tenant or employee) sharing the household of an employee of ours, or any entity that is either wholly or substantially owned or controlled by an employee of ours or any of the foregoing persons and any trust of which an employee of ours is a trustee or beneficiary) shall be subject to review and approval by our Audit Committee so that appropriate measures can be put into place to avoid either an actual conflict of interest or the appearance of a conflict of interest.

Stock Ownership Guidelines: Prohibition on Short-Term and Speculative Trading and Pledging

The Board has adopted stock ownership guidelines to further align the interests of ournon-employee directors and officers with those of our shareholders, by requiring the following minimum investment in company Common Stock:

| | |

ROLE | | MINIMUM OWNERSHIP |

Chief Executive Officer

| | 6x base salary |

Chief Operating Officer and Chief Financial Officer

| | 4x base salary |

All other NEO’s

| | 3x base salary |

Non-Employee Directors

| | 5x annual cash retainer |

Furthermore, our directors and each officer who is subject to the requirements of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan, with one director being granted an exception for the pledge of shares.

Compensation Committee Interlocks and Insider Participation

No Compensation Committee member (i) was an officer or employee of GPI, (ii) was formerly an officer of GPI or (iii) had any relationship requiring disclosure under the SEC’s rules governing disclosure of related person transactions. During the fiscal year ended December 31, 2017, we had no “interlocking” relationships in which (i) an executive officer of GPI served as a member of the Compensation Committee of another entity, one of whose executive officers served on the Compensation Committee of GPI, (ii) an executive officer of GPI served as a director of another entity, one of whose executive officers served on the Compensation Committee of GPI, or (iii) an executive officer of GPI served as a member of the Compensation Committee of another entity, one of whose executive officers served as a director of GPI.

PROPOSAL1- ELECTION OF DIRECTORS

Introduction

The Boardcurrently consists of teneight members and is currently divided into threetwo groups. OnePreviously each group of directors iswas elected at each annual meeting of shareholders for a three-year term. Each year a different group of directors iswas elected on a rotating basis. At the 2022 annual meeting, there was a declassification of the board of directors such that each group going forward will serve one-year terms through a phase in period until 2025. Beginning with the 2025 annual meeting, all directors will be elected annually.

The terms of James D. Anderson, Todd A. Becker, Thomas Manuel,Ejnar A. Knudsen III, Brian Peterson, and Alain Treuer and Kimberly Wagner are up for reelectionelection at the Annual Meeting (to serve until the 20212025 annual meeting or until their respective successors shall be elected and qualified). The terms of James Crowley, Gene EdwardsMartin Salinas Jr. and Gordon GladeFarha Aslam expire at the 20192025 annual meeting. meeting, at which time they will be up for annual election.

Board Recommendation

The termsBoard recommends that stockholders vote for each of Jim Anderson, Wayne Hoovestolthe nominees outlined.

Director Nominee Biographical Information and Ejnar Knudsen expireExperience

Nominees for Election at the

2020 annual meeting.

2024 Annual Meeting

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | James D. Anderson Chairman of the Board

Chief Executive Officer, Molycop Age: 66 Director Since: 2008 Committees: Compensation |

| | | | | | | | |

Director Qualifications Mr. Anderson is qualified to serve as a director because of his commodity experience and agribusiness knowledge, which provides the Board with a relevant depth of understanding of our operations. Past Public Company Directorships —United Malt Holdings | | | | | Background —Chief Executive Officer of Molycop since November 2017 —Served as Managing Director and Operating Partner at CHAMP Private Equity —Served The Gavilon Group, LLC as its President and Chief Executive Officer from October 2014 until February 2016 as well as its Chief Operating Officer, Fertilizer, since February 2010 —Served as Chief Executive Officer and member of the board of directors at United Malt Holdings, a producer of malt for use in the brewing and distilling industries, from September 2006 to February 2010 —Served as Chief Operating Officer / Executive Vice President of CT Malt, a joint venture between ConAgra Foods, Inc. and Tiger Brands of South Africa, beginning in April 2003 —Served as Senior Vice President and then President of ConAgra Grain Companies —His career has also included association with the firm Ferruzzi USA and as an Operations Manager for Pillsbury Company —Served as a Board Member of the North American Export Grain Association and the National Grain and Feed Association —Holds a Bachelor of Arts degree with a Finance emphasis from the University of Wisconsin - Platteville |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/ Marketing —Strategy Development | | | | —International Business —M&A/Partnerships —Capital Markets | —Audit/Risk/Cybersecurity —Legal/Regulatory/Gov’t Rel —Public Co/Corp Govern/ESG | —Executive Leadership —Executive Compensation |

| | | | | | |

| | | | | |

| 16 | GREEN PLAINS INC. 2024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Todd A. Becker President and Chief Executive Officer, Green Plains Inc. Age: 58 Director Since: 2009 Committees: None |

| | | | | | | | |

Director Qualifications Mr. Becker is qualified to serve as a director because he provides an insider’s perspective about our business and strategic direction to Board discussions. His extensive commodity experience and leadership make him an essential member of the Board. Current Public Company Directorships —Core Scientific Inc. (CORZ) Past Public Company Directorships —Hillshire Brands Company (HSH) —Green Plains Partners LP (GPP) | | | | | Background —Our President and Chief Executive Officer since January 2009 —Served as President and Chief Executive Officer, as well as a director, of Green Plains Holdings LLC from March 2015 to January 2024 —Serves on the board of directors of Core Scientific Inc. —Served as our President and Chief Operating Officer from October 2008 to December 2008 —Served as Chief Executive Officer of VBV LLC from May 2007 to October 2008 —Executive Vice President of Sales and Trading at Global Ethanol from May 2006 to May 2007 —Worked for ten years at ConAgra Foods, Inc. in various management positions, including Vice President of International Marketing for ConAgra Trade Group and President of ConAgra Grain Canada —Has 36 years of related experience in various commodity processing businesses, risk management and supply chain management, along with extensive international trading experience in agricultural markets —Mr. Becker has a Master’s degree in Finance from the Kelley School of Business at Indiana University and a Bachelor of Science degree in Business Administration with a Finance emphasis from the University of Kansas |

| | | | | | | | |

| | | | | | |

| Skills | —Industrial Mfg & Ingredient Prod —Commodity Markets/ Marketing —Strategy Development | | | | —International Business —M&A/Partnerships —Capital Markets | —Audit/Risk/ Cybersecurity —Legal/Regulatory/Gov’t Rel —Public Co/Corp Govern/ESG | —Executive Leadership |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ejnar A. Knudsen III Founder and Chief Executive Officer, AGR Partners Age: 55 Director Since: 2016 Committees: None |

| | | | | | | | |